W-9 Form Printable 2018-2025

Show details

Hide details

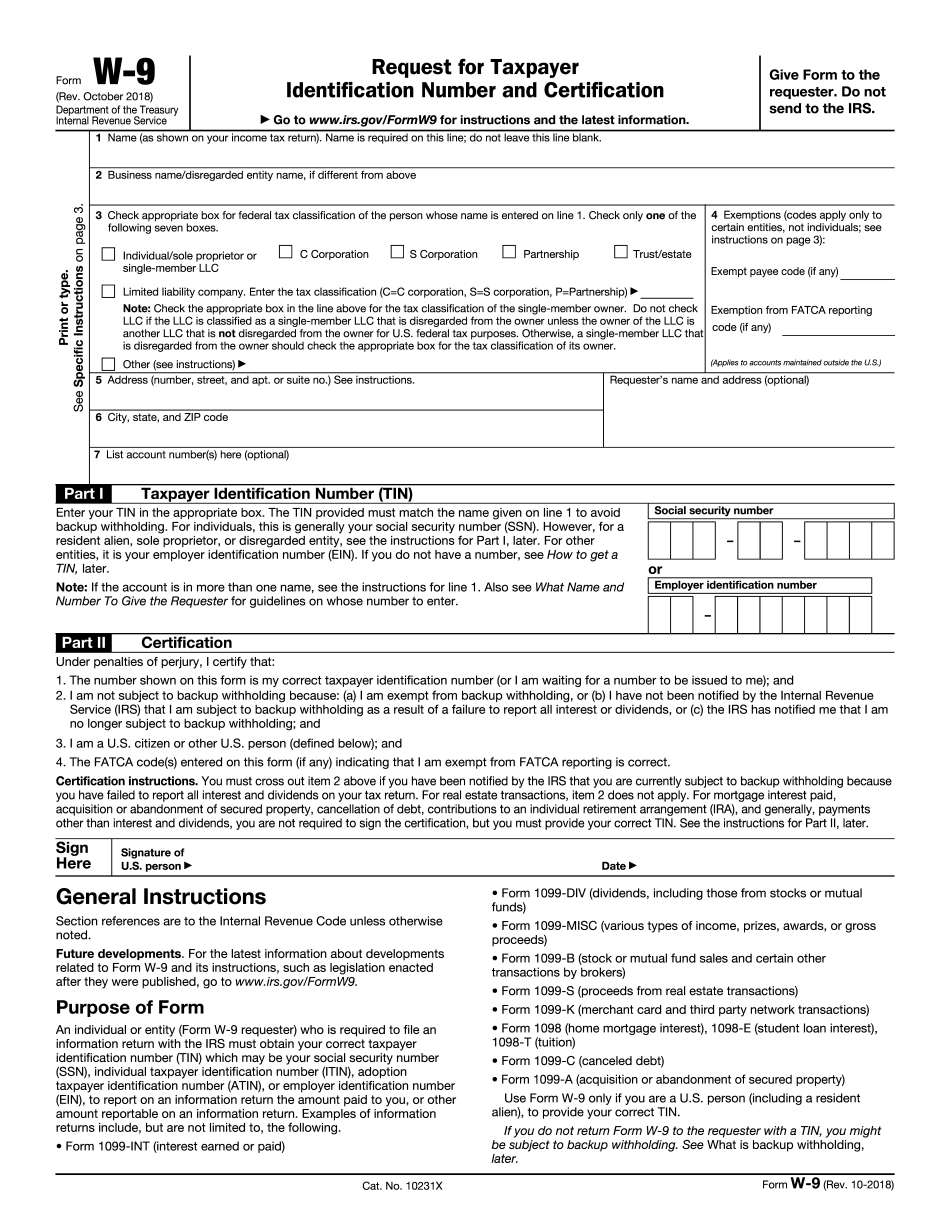

Enter the name. If the owner of the disregarded entity is a foreign person the owner must complete an appropriate Form W-8 instead of a Form W-9. Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person do not use Form W-9. See What is FATCA reporting later for further information. Note If you are a U.S. person and a requester gives you a form other than Form W-9 to request your TIN you must use the requester s form if ...

4.5 satisfied · 46 votes

w9-form-2019-printable.com is not affiliated with IRS

Filling out W-9 Form Printable online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to W-9 Form Printable

Every person must declare their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to W-9 Form Printable, our trustworthy and user-friendly service is here to help.

Follow the instructions below to W-9 Form Printable promptly and precisely:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your document utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Use the Highlight option to stress particular details and Erase if something is not relevant any longer.

- 06Click the page arrangements key on the left to rotate or delete unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding eSignature by adding its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal document delivery.

Select the simplest way to W-9 Form Printable and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare W-9 Form Printable

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of W-9 Form Printable?

The purpose of the form is to help you to understand the nature of your employment with an employer who has filed an W-9 Form. Information contained on the W-9 Form is not necessarily necessary to complete your tax return.

What happens when I fill out these fields?

To begin the W-9 form, you must complete the information as follows (assuming that you used the pay stubs of the employees you are required to file a tax return with, rather than the original forms):

Name of the employer.

Address of the work site, including the city and state, in which you conducted business with this employer.

Employment period.

Date of the activity that resulted in the employee being paid.

Date of the first pay stub you received.

Type of activity performed.

Type of employee. Example: Temporary employee.

Employer Identification Number (EIN).

Pay stub.

Name of employee.

Date of pay stub.

Name of employer.

Account number. Note: If you do not have an EIN, type the following:.

Date of issue/cancellation of W-2.

Date of the first pay stub you received.

Do I have to complete this form?

No. You do not have to complete form W-9 for any of the activities described in the section entitled W-9:

Retail trade.

Manufacturing.

Wholesaler-distributor.

Included in the W-9 Form:

Pay stubs from employees who engaged in one or more of the activities described above.

Pay stubs containing employment information for certain former employees who are no longer employed by the employer.

Do I have to be a U.S. citizen or legal permanent resident?

No, you do not have to be a U.S. citizen or resident to file a form required under the W-9. However, you must be either a lawful permanent resident, or an alien lawfully admitted for permanent residence.

When must I file the W-9 form?

You must file the W-9 form by the date that you receive the first pay stub.

Who should complete W-9 Form Printable?

If you're a sole trader or an employee who's working for the same employer, you should complete W-9 Form.

If you're self-employed, you should complete Form W-8.

If you are a member of a U.S. governmental corps, like a state or federal government, you should complete Form W-4 instead.

Related Information

For more information on completing W-9Forms in the U.S.

When do I need to complete W-9 Form Printable?

A complete Form W-9 form can be submitted by any business in which the taxpayer is an agent on December 31. For taxable years after 2016, the Form 1040 can be submitted as soon as it is received in the IRS mail. The Form W-9 can be submitted before the IRS sends you the tax forms you need to file.

Form W-9 must be filed electronically if the business has an Internet presence. If a business does not have an Internet presence, the Form W-9 can be filed by submitting the Form W-9 to the IRS. If multiple Form W-9s are received from the IRS on or before the due date, the IRS will determine the most appropriate form for processing. Submit all required Forms W-9 by the due date. The taxpayer should include Form W-9 in any income tax returns and/or tax prepayments that they submit and in any other documents they send to the IRS. See What Documents Must I Submit to the IRS if you need to file a Form W-9.

W-3

A Form W-3 can be submitted before the Form W-9 is. The Form W-3 can be uploaded to the electronic payment system, if you use one. If a business does not have an electronic payment system, the Form W-3 can be uploaded to a paperless system and the business will receive a paper copy. The Form W-3 is not required to be filed with this form.

Form W-2G

A form for self-employment tax return, available in the 2017 and 2018 tax years, has an electronic payment option. The Form W-2G forms are for businesses that have one or more employees. The employer has to pay the self-employment tax on behalf of the employee. The Form W-2G is not required to be filed with this form.

Form W-2G-S

A form for self-employment tax return, available in the 2017 and 2018 tax years, has an electronic payment option. The Forms W-2G-S are for businesses that have more than one employee but none who are employees. The employer has to pay the self-employment tax on behalf of the employee. The Forms W-2G-S are not required to be filed with this form.

Form W-2J

Form W-2J can be submitted the same day as the Form W-9 if it has an electronic payment option.

Can I create my own W-9 Form Printable?

No. If you have already provided the information that is contained in the W-9 Form (such as the employer's name and address, the name of the recipient, the total wages, deductions, and wages paid, and the date of the payment and employer/payee relationship), you cannot submit it digitally. You must take your paper copy of the W-9 Form to a payee or agency (such as payroll, payroll services, or the IRS) to complete the required pages to complete an S-2B. This applies regardless of the method you have chosen to file or receive your W-4.

If you received wages paid by check, that payer must send you a check for the amount of wages that you're receiving, or you can include the earnings in your adjusted gross income. If the check arrived by mail rather than by check, you must send the payee a copy of the W-9 Form to be filed electronically, along with the required stamps and postage and a copy of the W-4 form, including the social security number, to complete the required pages of an S-2B.

If you receive wages paid by a different form of payment, such as a check from a nonemployer (such as a family member), they need to have the same information as the employer, unless it is necessary to ensure complete identification (such as an employee sharing a bank account or debit card) or financial records. You do not need to provide the employer's name here unless you are filing the S-2B as a joint return, or you are filing a joint return with an unmarried partner, and then if the payee is also filing an S-2B.

What if I cannot find a W-9 Form or an S-2B online?

You cannot use the S-2B to electronically file or receive wages from an employer. You do not need to wait until after your W-4 is available and filed, even if you're expecting W-4S (Pay As You Earn) income, if you cannot find a W-9 or an S-2B online. If you can't find the appropriate form, you must contact the employer. The employer can be contacted by phone, mail or in person. For more information about locating an employer and reporting wages, call in the USA or + outside the USA.

What should I do with W-9 Form Printable when it’s complete?

Do not proceed without the W-9 Form printable. After you have submitted the completed W-9 form, you will need to print out the new form and send it to the appropriate IRS address.

Where can I get the form?

The W-9 Form Printable is here.

When will my Form get approved?

Once you have sent in your W-9 Form, the Form will be reviewed and approved in 24-48 hours.

Is my W-9 form safe and secure?

Yes, your W-9 form can easily be downloaded, opened in a PDF viewer and sent. No personal information is collected.

What do I do when I submit the W-9 form?

When sending your Form W-9 to the U.S. government, be sure to include all the required information. If you have any questions about whether to send your form, please contact us by mail or call.

My W-9 form was returned to me for failure to sign and date it. How do I correct the errors?

We recommend you take the following steps if a non-sufficient information form is returned to you. You should first contact the IRS and request that they re-send the information so that the errors can be corrected. If you choose to make corrections on your own, the IRS will correct the tax return as soon as possible. The IRS will contact you within 6 weeks once you have submitted your correction.

1. For form W-9, check the box that confirms the correct information.

2. Include your original signature.

3. Check the box that states, “Sign this section”.

4. Fill out the rest of the form.

How do I get my W-9 Form Printable?

If you are able to print the W-9 Form, you can get the Form from the IRS. Simply go to and click on W-9 Forms.

How do I print the W-9?

The W-9 form is now a printer-friendly form, so you can print it at home, on a computer, or download it to your tablet, personal computer, or other device. To print the W-9, see instructions on my Forms page.

How long will the W-9 take?

The W-9 process usually takes between 1 and 2 business days at the most to process when there is no processing fee. If you pay the processing fee, it may take 3 to 5 business days to process, depending on the number of paper forms due and the number of pages in the forms. You will receive an email that your payment has been completed.

More about W-9 instructions below.

Do I have to send the W-9 by mail?

No. Many large businesses that offer benefits that qualify them for lower payroll taxes under self-employment tax rules include their W-9 requirements along with other documents they send the employer.

Who needs to send the W-9 to the employer?

Anyone who receives your W-9 is a business you must submit the form. This includes the owner and director for each unit (or owner. Director), as well as all employees.

Who needs to file a W-9?

For all employees, no matter how high the pay, all employees must provide the information from their forms for the business they work for. This can be done electronically by using Form SS-4 or Form SS-5. If you are an independent contractor, you must also include your independent contractor name in the EIN, or individual taxpayer identification number.

Where is my personal W-9 located?

It is the employer's responsibility to keep your W-9 on file at their address where you file them. If this is not the case, contact your state's employer of record for the forms you filed in the past. The last three digits of your Social Security number (SSN) is printed on your W-9. If you have a W-9 from a prior year, look for that number on a notice from the IRS.

What documents do I need to attach to my W-9 Form Printable?

Download one of the following documents to help you attach a required W-9 to your electronic Federal tax return.

Note: If the documentation includes a W-10B Schedule for your business, you will need to attach the appropriate Form W-10B, Form 1099 for your business. If you receive additional forms for your business listed as non-payment or if you need additional W-9 Form(s), you can send them to the IRS at the following address:

Attn: Forms and Publications

Internal Revenue Service

33 Liberty Street SE., Room 1061-C

Baltimore, Maryland 2

You will need to file the W-9 with the business.

To download a PDF with all W-9 instructions, click here.

How do I file electronically once I have attached all W-9 forms?

You can file an electronic Federal tax return. To do this, you will have to create a profile, an IRS account and your E-file credentials. After you finish your online tax return, you will need to print your tax return, file it and then send it in to the IRS. You can send your tax return to the following email address for more help:

Send your completed return, including all additional documentation to:

E-file Information Center

Internal Revenue Service

Taxpayer Assistance Center

Mail Stop No.

P.O. Box 9999

Baltimore, Maryland 2

Why do I need to attach a copy of my W-9 form for a return that includes only paper documentation, but I'm not sure how to attach a copy of my W-9 form to my electronic return?

You must have all of your required W-9 forms attached before you send your return as evidence. The IRS will attach your copy of the W-9 forms to your electronic return. You will not be able to make a claim on the return until you attach the W-9 forms to your return.

I do not have access to my e-file credentials, are there other ways to file electronically?

You can use one of the options described below to file your return. You will not be able to claim any refunds, and you will not be able to attach your W-9 or other forms until you have your credentials.

What are the different types of W-9 Form Printable?

Here is a quick breakdown of the types of W-9 Form Printable forms:

Employment tax withholding (E-6, E-4) is used to pay wages and other employee compensation.

Wages are deducted in the form of W1's or W2's.

Social Security (SS) taxes are paid using Form 1042, or Form 1094.

Deductions from employee compensation are paid using Form 1041.

Social security and federal unemployment tax (FTA) are the two payroll taxes paid.

FICA tax is used to pay Medicare portion of employee compensation.

How many people fill out W-9 Form Printable each year?

How many people fill out the W-2 Form?

How many people fill out the 1099 Forms?

How many times do employers have to file a W-2 Form with Forms and Publications?

Which W-2 or 1099 Form is best for you and your company?

How big is a W-2 Form? What do they mean?

What is the difference between “Payroll” and “Tax” Forms?

What are the most common mistakes on W-2s?

What is the Difference between W-2, 1099 and 1099-MISC Forms?

Which is the best form to use for your business? It varies depending upon the situation and the type of business.

1. What is a W-2 Form?

A W-2 is an annual pay stamp issued to your company by the IRS. It shows you what your company paid to each of its employees each year and how much was paid to each federal employee on behalf of all the company's employees. If you are filing a W-2, make sure it is properly completed because the information will be used during the 1099 Form you file with the IRS.

2. What is a 1098-T?

A 1098-T is a tax return filed by an employer and a tax preparer. It is also called a W-2-EZ or W-2eZ. When the 1098-T is properly filed, you must also include the information about employees and their wages. The information is used by the IRS to help determine:

How much your 1099-MISC company should pay each pay period to employees

How much tax your 1099-MISC company is required to pay, based on your W-2, 1098, 1099, or 1120

The amount the IRS pays an employee in the year.

If you are filing a W-2 from a business other than a small/medium business, and you need to tell us about your business, we will need to know the name of the other business along with the business description you use for this form. This information will also be helpful in the final 1099-MISC.

3.

Is there a due date for W-9 Form Printable?

Click here for more information.

What if I am not a U.S. citizen?

Do I have to file? If not, there are two types of individuals who do not have to register for federal income tax: residents of foreign countries and residents of U.S. islands and possessions. There are also individuals who voluntarily file and submit the return of U.S. earnings. You must be a U.S. citizen, resident alien, or a nonresident alien to be an individual required to file a return, report a loss, or pay any amount of income tax.

When should I file? There is no time limit. Individuals file on the last day of the month during which they file their most recent return with the IRS. A joint return is subject to filing by both individuals.

Are there any exceptions to my W-9 or 1099 report? You may voluntarily report foreign currency earned on a business trip that you did not pay for. However, you must file U.S. income tax reports under the W-9 Form and pay U.S. income tax on these losses. See “Form Information to Prepare W-9 and 1099” for more information.

There is no specific time for reporting foreign currency on your W-9 or 1099. However, there are certain exceptions for certain types of foreign exchange transactions: Payments you receive that could be considered gifts or transfers in property from an eligible taxpayer.

Certain payments or other forms of remuneration you receive, if a U.S. person other than you controlled the recipient, on an amount that equals or exceeds 75,000 in any 12-month period during the preceding calendar year. However, if the recipient is related by blood, marriage, adoption, or legal adoption to the exempt recipient, or you control such a recipient, see Example 6 to determine if you have to report.

Payments you receive that could be considered gifts or transfers in property from an eligible taxpayer. Certain payments or other forms of remuneration you receive, if a U.S. person other than you controlled the recipient, on an amount that equals or exceeds 75,000 in any 12-month period during the preceding calendar year. However, if the recipient is related by blood, marriage, adoption, or legal adoption to the exempt recipient, or you control such a recipient, see Example 6 to determine if you have to report.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here